Office Address: Sunmoon Science Park, 985 Xingzhong Road, High-Tech Zone, Bengbu, China Factory Address: Mohekou Industrial Park, Huaishang District, Bengbu, Anhui, China Contact: Ariel Young Phone: 0086-552-3827158 FAX: 0086-552-3822922 Mobile: 0086-15255290433 WebSite: www.siliconeoil.cn

www.siliconeoil.net

Email: sales@siliconeoil.net QQ:

|

IOTA 6289 Methyl Silicone Resin for Concrete and Stone

Polyethylsiloxane Fluids IOTA 2056 PES

Ethyl Silicone Rubber IOTA 2056 HTV

Ethyl Silicone Rubber IOTA 2056 GUM

Single-terminated trimethoxyl-terminated silicone oil IOTA-2307

Mercapto modified silicone oil IOTA-280

IOTA 5532 Methoxytriphenylsilane

IOTA 5722 methoxy(methyl)diphenylsilane

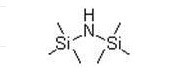

Tetramethyldisilazane IOTA 5205H

Super Hydrophobic Nano Ceramic Coating IOTA ST6

Fluoro Silicone Gum

Self-drying Silicone Resin IOTA 6605L

Self-drying Silicone Resin IOTA 6604

Methyl silicone resin IOTA 6080

IOTA 6608/6609 Pure Organic Silicone Resin Emulsion

IOTA 6607 Epoxy Organic Silicone Resin Emulsion

IOTA 6606 Acrylic Organic Silicone Resin Emulsion

IOTA 1501 Cyclopentasiloxane and Dimethiconol

IOTA 201-1 Octamethyltrisiloxane

Carbinol Silicone Oil IOTA 28300

Phenol Terminated Silicone Oils

1,3-Bis(3-aminopropyl)-1,1,3,3-tetramethyldisiloxane IOTA2458

Hexamethylcyclotrisilazane IOTA-N202

Water-based silicone resin IOTA 6850S

Water-based silicone resin IOTA 6830S

Polyester modified silicone resin IOTA 6072A

Polyester modified silicone resin IOTA 6072-50D

Polyester modified silicone resin IOTA 6072-15

Polyester modified silicone resin IOTA 6038A

Methyl phenyl silicone resin IOTA 6156C

Methyl phenyl silicone resin IOTA 6153D

Methyl phenyl silicone resin IOTA 6056D

Methyl phenyl silicone resin IOTA 6056

Methyl phenyl silicone resin IOTA 6053G

Epoxy-modified silicone resin IOTA E60

Epoxy-modified silicone resin IOTA E30

Epoxy-modified silicone resin IOTA E25

Epoxy-modified silicone resin IOTA 6063-55

Alkyd modified silicone resin IOTA 6057

Acrylic polysiloxane resin IOTA BXS-90

Acrylic modified silicone resin IOTA 6146A

Acrylic modified silicone resin IOTA 6146

Acrylic modified silicone resin IOTA 6046

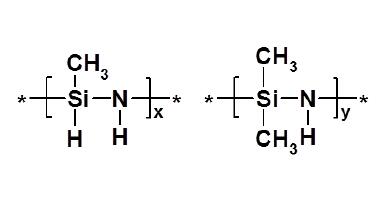

Organic Polysilazane IOTA 9283

Organic Polysilazane IOTA 9150K

IOTA 9028 Dichloro-bis(chloromethyl)silane

Non-foaming defoaming wetting agent IOTA 4100

Eco-friendly Solid Silicone Resin IOTA 6106

Eco-friendly Solid Silicone Resin IOTA 6105

Eco-friendly Solid Silicone Resin IOTA 6103

IOTA 3090A acrylic modified silicone resin

IOTA 1153D methyl phenyl silicone resin

IOTA 1146 acrylic modified silicone resin

IOTA 1127 polyester modified silicone resin

IOTA 1123 silicone resin intermediates

IOTA 1072A polyester modified silicone resin

IOTA 1063-55 epoxy modified silicone resin

Transparent super hydrophobic nano coating IOTA ST5

Carboxyl Silicone Oil IOTA 2520

Double-ended hydroxypropyl silicone oil IOTA 2030

Double-ended alcohol hydroxyl long-chain alkyl silicone oil IOTA 8865H

Double-ended alcohol hydroxy silicone oil IOTA 2110

Diol hydroxyl single-end long-chain alkyl silicone oil IOTA 8866

Diol hydroxyl single-end silicone oil IOTA 2176

Hydroxyl terminated methyl vinyl silicone oil IOTA 1203V

Acrylic Silicone Oil IOTA 2205

Single-ended hydroxypropyl silicone oil IOTA2050

Alcohol hydroxy single-ended long-chain alkyl silicone oil IOTA 8861

Single-ended alcohol hydroxyl silicone oil IOTA 2170

Side Chain Acrylate Modified Silicone Oil IOTA 170

Acrylic Silicone Oil IOTA 2220

Polycarbosilane adhesive IOTA H11500

Polycarbosilane adhesive IOTA H21500

Borosilazane adhesive IOTA H21400

Silazane Adhesive IOTA H21000

Silazane adhesive IOTA H31000

High temperature curing silicone sealant IOTA H1400

Modified cyanate ester adhesive IOTA RH3400C

Silicone resin modified cyanate ester Adhesive IOTA R3400

Fast curing high temperature resistant putty IOTA R31800F

High temperature resistant putty IOTA R31800

Silicone sealant IOTA R1400

Phenolic Modified Cyanate Adhesive IOTA R3600

Fasting curing silazane adhesive IOTA R3800F

Silazane ceramic precursor adhesive IOTA R31000

Silicone oxynitride adhesive IOTA R3800

High temperature resistant silicone adhesive IOTA R2400

Hexamethylcyclotrisiloxane IOTA D3

high temperature resistant water-based nano ceramics coating IOTA ST4

Highest hardness Nano-coating in room temperature cured IOTA ST3

Waterborne nano high hardness self-cleaning coating IOTA ST2

Waterborne nano high hardness self-cleaning coating IOTA ST1

Low volatile silicone oil

Low viscosity hydroxyl fluoro silicone oil IOTA40F

Modified hydroxypropyl silicone oil (aqueous system)IOTA2040

Single-ended hydroxypropyl silicone oil IOTA2050

Bicomponent structured adhesive

IOTA 7000 (6000 Anti-fogging agent)

Epoxy double heads IOTA-010

Acrylate modified silicone oil IOTA 2032

Acrylate modified silicone oil IOTA 2031

IOTA 201-2 Dimethicone 2cst

Epoxy silicone oil chain extender IOTA 105-1000

Epoxy polyether silicone oil

IOTA 345 Cyclopentasiloxane and Cyclohexasiloxane

Drift control adjuvant IOTA-331

IOTA 9970

Silicon dioxides for coating

Hydrophobic series silica

IOTA FINE-SIL520A Silicon Dioxide

IOTA FINE Silicon dioxide

IOTA 96212 Silicone Elastomer Gel

IOTA 96211 Silicone Elastomer Gel

IOTA 96082 Silicone Resin Elastomer Suspension

IOTA 96061 Silicone Elastomer Powder

IOTA 96004 Silicone Resin Elastomer Gel

IOTA 9609 Silicone Elastomer Gel

IOTA 9608 Silicone Elastomer Suspension

IOTA 9607 Silicone Elastomer Gel

IOTA 9606 Silicone Elastomer Powder

IOTA 9600D Silicone Elastomer Gel

IOTA 9600B Silicone Elastomer Gel

IOTA 9600 Silicone Elastomer Gel

Organic polyborosilazane (Potteryable precursor polymer) IOTA 9120

Nano silica dispersion IOTA 100F1, IOTA 100F2

Hydrophobic Silica IOTA 90-02

Hydrophobic Nanometer Silica IOTA 90-01

Hydrophilic type nano-silica IOTA 100

Anti-graffiti silicone resin IOTA-TC1

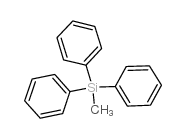

IOTA 5803 Methyltriphenylsilane

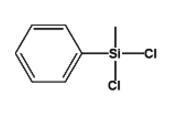

Methyl phenyl dichlorosilane IOTA5804

Organic polysilazane IOTA 9108

Organic polysilazane IOTA 9118

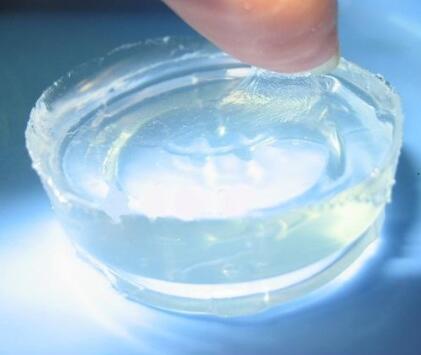

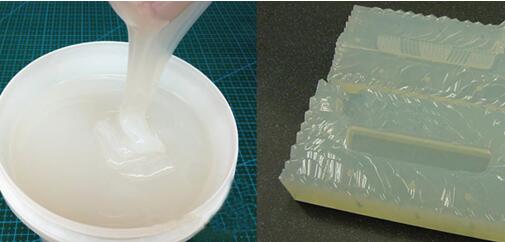

High transparency mold making silicone rubber

Food grade silicone rubber for mold making

Condensation type mold silicone rubber

High refraction index phenyl silicone packing gel IOTA 34255

High temperature lubricating oil IOTA-255B

High temperature resistant silicone oil IOTA-255A

Organic silicon industrial cleaning agent IOTA2018

Sealed silicone grease IOTA 2014

Thermal Grease IOTA 2013

Lubricating silicone grease IOTA2012

OctaMethyltetrasiloxane IOTA2101

Methyl-bis(trimethylsilyloxy)silicon IOTA2100

Silicone products multi holes cake mold IOTA 41007

silicone rubber material for Flame retardant high temperature resistant IOTA 26E9-40,50,60

Silicone rubber material for swimming class equipment with IOTA351-20, 30, 40, 856-20, 221-20

Silicone rubber material for Medical apparatus and instruments IOTA5971-60*, 70* ,80*,IOTA971-60* ,60K

Liquid silicone rubber material IOTA-6120 15, 20, 20-H

Silicone rubber material for auto parts IOTA 231-20*

Silicone rubber material for wire, tubular product IOTA4366-30, 40, 50, 60, 70, 80

Silicone rubber material for wearable digital electrical accessories IOTA 151-30A, 40A, 50A, 60A, 70A, 80A

Silicone rubber material for home appliance accessories and miscellaneous pieces IOTA151-10, 20, 30, 40, 50, 60, 70, 80, 90

Silicone rubber material for industrial products IOTA9241-20*,30*,40*,50*,60*

Silicone rubber material for electrical power, communication IOTA141-40*, 50*, 60*

Silicone rubber material for Kitchen utensils and appliances industry class IOTA151-10, 20, 30, 40, 50, 60, 70, 80, 90

Silicone rubber material for office automation IOTA151-30, 40, 50

IOTA GF998 Fire Resistant Silicone Weatherproofing Sealant

IOTA 1098 High Performance Silicone Weatherproofing Sealant

IOTA GF999 Fire Resistant Silicone Structural Glazing Sealant

IOTA 1092 High Performance Silicone Structural Glazing Sealant

IOTA 998 Silicone Weatherproofing Sealant

IOTA 997 Silicone Sealant For Stone Applications

IOTA 995 Silicone Sealant For Total Vision System

IOTA 992 Silicone Structural Glazing Sealant

IOTA DJ310 Hollow glass hot melt butyl rubber

IOTA 119 Fire Resistance Silicone Sealant

IOTA 997 Silicone Sealant For Stone Applications

IOTA 993 Silicone Sealant for Skylight

IOTA 887 Dry hanging stone elastic rubber

IOTA 886 Silicone Structural Insulating Glass Sealant

IOTA 882 Silicone Insulating Glass Sealant

IOTA GZ series Thermal conductive silicone

IOTA 3400 Silicone heat conductive gasket

IOTA 3300 Silicone heat conductive gasket

IOTA 3100 Silicone heat conductive gasket

IOTA800FG Thermal insulator sheet

Cationic hydroxy silicone oil emulsion IOTA-2051

Anionic hydroxy silicone oil emulsion IOTA-2052

Epoxy silicone oil emulsion IOTA-1051

Hydrogen silicone emulsion IOTA 2021

Precipitated Silica IOTA9002

Silicone wax

IOTA SA408FG Thermally conductive double-sided adhesive tape

IOTA 4815W single component silicone sealant

IOTA 4815Z single component silicone sealant

IOTA 4815C One component silicone sealant

IOTA DJ330 Hot melt butyl

IOTA 4926 Silicone sealant for new energy automotive safety power

IOTA 4808 Silicone Electronic Potting Sealant

IOTA 888A Silicone Sealant for Solar Modules

IOTA 855 Silicone Sealant for Solar Modules

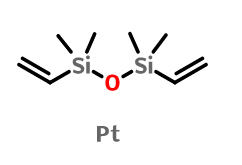

Platinum(0)-1,3-divinyl-1,1,3,3-tetramethyldisiloxane (the platinum catalyst) IOTA-8100

High temperature resistant silicone emulsion IOTA 240

Hexamethyldisilane IOTA-5002

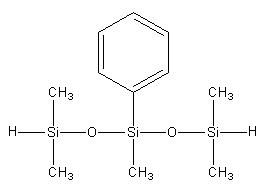

Pentamethylphenyl dihydrotrisiloxane IOTA-2238

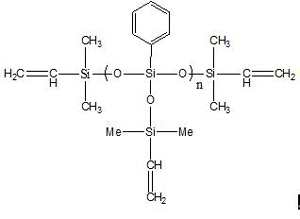

Vinyl terminated T-type phenylpolysiloxane IOTA-253

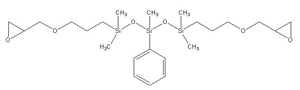

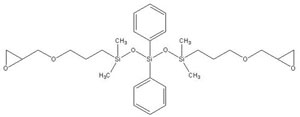

Epoxy-terminated phenyltrisiloxane IOTA-279

Epoxy-terminated phenyltrisiloxane IOTA-278

High elastic foam silicone strip IOTA-4801

High elastic silicone foam sheet IOTA-4800

Phenyl silicone oil emulsion IOTA PEMUL 255

New type of silicone chain extension agent IOTA-4001

High refractive index plasticizer IOTA-9006

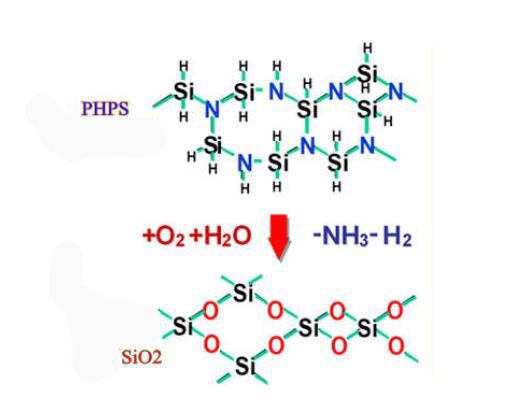

Perhydropolysilazane IOTA-PHPS

Heat Curable Coating Resin IOTA-OPSZ-1800

Organopolysilazane IOTA-OPSZ-9150

LED GEL refractive index regulator IOTA-9005

High refractive index silicone oil IOTA-259A

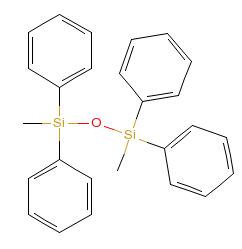

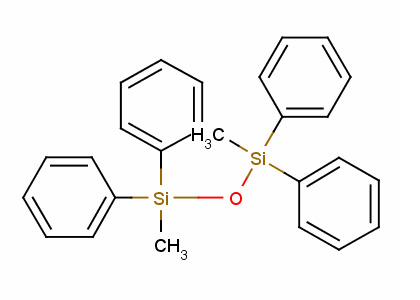

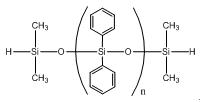

Dimethyltetraphenylsiloxane IOTA 259

Tetraphenyldimethyldisiloxane

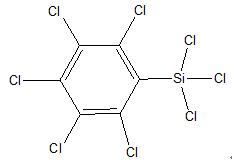

Pentachlorophenyl trichlorosilane

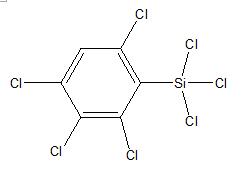

Tetrachlorophenyl trichlorosilane

AB Liquid Silicone rubber foam IOTA-663

IOTA 201-1.5 Dimethicone 1.5cst

Silicone waterproof coating IOTA-301

Copolymer resin series mold materials for foam lost casting IOTA-STMMA

Long Glass Fiber Reinforced Polyamide IOTA-LFT-PA

Long Glass Fiber Reinforced Polypropylene IOTA-LFT-PP

Methylphenyl silicone resin IOTA-B202

Phenyl silicone resin IOTA-B201

Epoxy-modified silicone resin IOTA H-60

Epoxy-modified silicone resin IOTA-H-30

Polyester modified silicon resin IOTA-1062G

Modified silicone resin IOTA-1057

Pure silicone resin IOTA-1056D

Pure silicone resin IOTA-1056

Pure silicone resin IOTA-1053G

Polyester modified silicone resin IOTA-1046

Polyester modified silicone resin IOTA-1038A

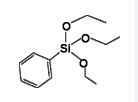

Phenyltriethoxysilane IOTA-531

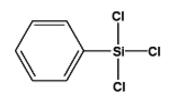

Phenyltrichlorosilane IOTA-525

Phenyltrimethoxysilane IOTA-530

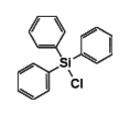

Triphenylchlorosilane IOTA-529

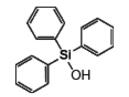

Triphenylsilanol IOTA-528

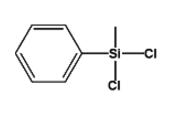

Methylphenyldichlorosilane IOTA-527

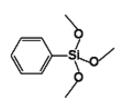

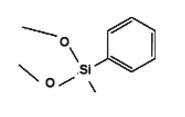

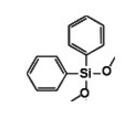

Methylphenyldimethoxysilane IOTA-526

Dimethyl Diphenyl Cyclics IOTA-524

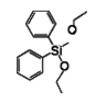

Diphenyldiethoxysilane IOTA-523

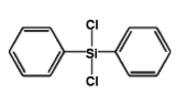

Diphenyldichlorosilane IOTA-522

Diphenyldimethoxysilane IOTA-521

Silicones for Technical Fabrics and Leathers IOTA-TCS-7001

PHENYL SILICONEGUM(HTV)IOTA- 34

Diphenyl tetrasiloxane IOTA 234

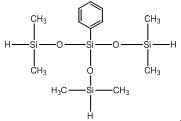

Phenyl-tris(dimethylsiloxy)silane IOTA 235

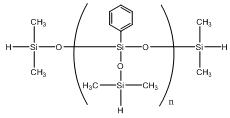

Phenylsilsesquioxanes hydrogen-terminated IOTA 233

Dihydroxydiphenylsilane(DPSD) IOTA R05

Cyclophenylmethicone IOTA R21

High security hydroxyl silicone oil for fumed silica IOTA 1203D

Linear hydroxyl silicone oil IOTA 1203M

Hydroxyl blocking methyl vinyl silicone oil IOTA 1203V

Methoxy blocking polymethyl silicone oil IOTA 1204A

Ethoxy blocking polymethyl silicone oil IOTA 1204B

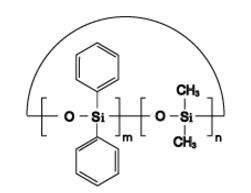

Methyl phenyl methoxy silicone oil IOTA 1204C

DIMETHICONE IOTA DM 10

DIMETHICONE IOTA DM50 - DM1000

DIMETHICONE IOTA DM5000 – DM60000

Cyclopentasiloxane IOTA CM5 A2

Low Viscosity Silicone Oils IOTA PDMS 47V3 - 47V10

Middle Viscosity Silicone Oils IOTA PDMS 47V50 - 47V1000

High Viscosity Silicone Oils IOTA PDMS 47V5000 - 47V500000

Personal care silicone oil IOTA 29161

Triphenylsilanol IOTA R06

MePhOH-group silicone oil IOTA R32

Hexamethyldisilazane(HMDS) IOTA 011

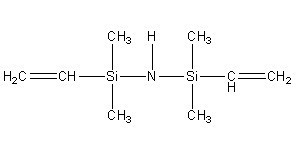

Vinyl silazane IOTA 51001

Dimethyldivinylsilane IOTA-501

Dual-head vinyl silicone oil IOTA VM-19

Multi-vinyl silicone oil IOTA VM-26

Cyclopentasiloxane dimethiconol IOTA 1021 IOTA 1022

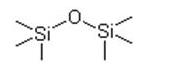

Hexamethyldisiloxane IOTA 005

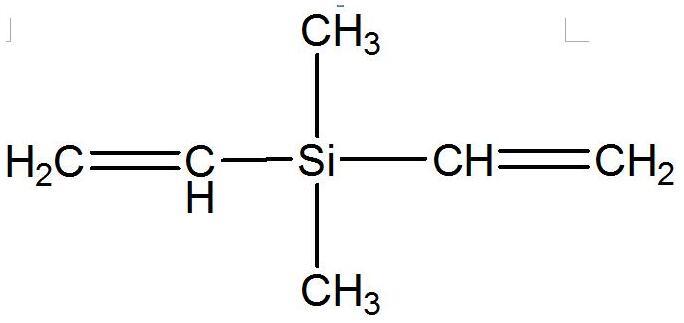

Divinyltetramethyldisiloxane(Vinyl double heads) IOTA 1002

Methylphenyldiethoxysilane IOTA-826

Diethoxydiphenylsilane IOTA-814

Diphenyldimethoxysilane IOTA-813

Phenyltriethoxysilane IOTA-802

Phenyltrimethoxysilane IOTA-801

Trimethoxysilylpropanethiol IOTA-590

3-Mercaptopropyltriethoxysilane IOTA-580

3-Ureidopropyltriethoxysilane IOTA-1160

γ-Ureidopropyltrimethoxysilane IOTA-1524

Anilino methyl triethoxysilane IOTA-42

Bis(trimethoxysilylpropyl)amine IOTA-1170

3-(2-Aminoethylamino)propyl-diethoxymethylsilane IOTA-5702

N-(2-aminoethyl)-3-aminopropylmethyl-dimethoxysilane IOTA-602

N (2-aminoethyl) -3-aminopropyltriethoxy-silane IOTA-910

N (2-aminoethyl)-3-aminopropyltrimethoxy-silane IOTA-792

3-(Diethoxymethylsilyl)propyl methacrylate IOTA-671

3-(Triethoxysilyl)propyl methacrylate IOTA-670

3-Methacryloxypropylmethyldimethoxy silane IOTA-571

3-methacryloxypropyltrimethoxysilane IOTA-570

3-Glycidoxypropyltrimethoxysilane IOTA-560

Vinyl tris(2-methoxyethoxy) silane IOTA-172

Dimethicone and Dimethiconol IOTA1403

Cyclopentasiloxane (and) Cyclotetrasiloxane (and) Dimethiconol IOTA1401

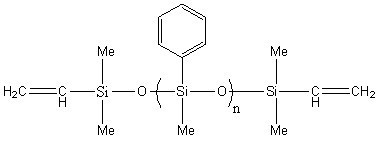

Methyl phenyl vinyl silicone rubber IOTA 120

Hexamethyldisilazane(HMDS) IOTA 011

Dimethyl Vinyl Ethoxy Silane (Vinyl single end ) IOTA-DVES

Trimethylchlorosilane M3

Powder Agricultural Silicone synergist IOTA2001

High temperature resistant release agent emulsion IOTA-257-60

IOTA BP9500 Building protective waterproofing agent

Silicones for Technical Fabrics and Leathers IOTA 7001

IOTA 1647V75 Organo Functional

Leather processing waterproofing agent IOTA 1669

IOTA 70827A EMULSION CATALYST

Water Repellent IOTA EMUL 269

Water Repellent Treatment IOTA WR 68

Building Protection Water repellent additive IOTA BP 9705

Water based coating release agent IOTA MR5900

Solventless methyl silicone resin release agent IOTA RES 9515

Release agent IOTA 2206

Universal defoamer agent IOTA C585

High-performance silicone-based organic silicon compound IOTA C583

High-performance silicone-based organic silicon compound IOTA C581

Black liquor defoamer IOTA C563

Silicone defoamers IOTA C545

Low refractive LED Encapsulants

Methyl vinyl MQ silicone resin IOTA-AM

Methyl hydrogen cross-linking agent IOTA-AF

Octaphenyl cyclotetrasiloxane IOTA-AKT

Smooth and standing silicone oil for cotton IOTA 805

Super soft hydrophilic block silicone oil for cotton IOTA J50A

Super soft smooth hydrophilic block silicone oil for cotton IOTA N30

Smooth and soft silicone oil for cotton IOTA 817

vinyl ketone group, the crosslinking agent IOTA-91

Phenyltris methylethylketoximio silane IOTA-36

Methyltris(methylethylketoxime)silaneblend IOTA-32

Methyltrimethylethylketoximesilaneblend IOTA-31

Tetraethxoysilane-40 IOTA-130(Si40)

Ethyl silicate / Four oxygen radical IOTA-130(Si28)

Tetramethoxysilane (methyl orthosilicate) IOTA-5101

Methyltriethoxysilane IOTA-150

1,2-bis trimethoxysilyl ethane IOTA-26

Poly methyl triethoxysilane IOTA-23

Methylethyl triacetoxy silane IOTA-18

Methylpropyltriacetoxysilane IOTA-17

Propyl triacetoxy Silane IOTA-16

Ethyl triacetoxy silane IOTA-15

Modified methyltriacetoxysilane IOTA-13

Modified Methyltriacetoxysilane IOTA-12

Di-t-butoxydiacetoxysilane IOTA-11

Methyltriacetoxysilane IOTA-10

Mercaptopropyltriethoxysilane IOTA580

Vinyltris methoxyethoxysilane IOTA 172

Vinyltriethoxvsilane IOTA 151

aminopropylmethyldiethoxysilane IOTA 902

aminopropylmethyldimethoxysilane

Aminopropyltriethoxysilane IOTA 550

Trimethoxysilane IOTA 160

Construction sealant Oxime

Construction sealant Acetic

High transparent liquid silicone rubber LSR IOTA 6300

High tear strength and high temperature vulcanized silicone rubber IOTA HD

Safety cable silicone rubber MF IOTA 8465

High damping coefficient and resistance to low temperature IOTA MM 771 Series

High temperature stability silicone rubber IOTA THT

Outstanding high mechanical properties silicone rubber IOTA HP Series

High rebound and low compression set silicone rubber IOTA HCR 2900 Series

Good mechanical properties general silicone rubber IOTA HCR 1900 Series

Economic general silcone rubber IOTA HCR 1600 Series

Process ability silicone rubber IOTA HCR 9100 Series

High rebound silicone rubber IOTA HCR 900 Series

High tear stength and high transparent silicone rubber IOTA HCR 300 Series

High transparent extrusion silicone rubber IOTA HCR 100 Series

IOTA 795 Methyl vinyl silicone rubber

IOTA 759 Methyl vinyl silicone rubber

IOTA 755 Methyl vinyl silicone rubber

IOTA 753 Methyl vinyl silicone rubber

IOTA 751Methyl vinyl silicone rubber

IOTA107 V150000-V550000 High viscosity linear hydroxyl-terminated polydimethylsiloxane

IOTA107 V5000-V80000 low viscosity linear hydroxyl-terminated polydimethylsiloxane

IOTA 107 V500-V3000 low viscosity linear hydroxyl-terminated polydimethylsiloxane

IOTA1021Cyclopentasiloxane IOTA 1022Dimethiconol

Low compression set silicone rubber IOTA HCR 200 series

IOTA D5 Cyclopentasiloxane

RTV Methyl silicone rubber

Methyltrichlorosilane

Methyldichlorosilane

Dimethyl siloxane cyclics mixture

Dimethylchlorosilane

Silica

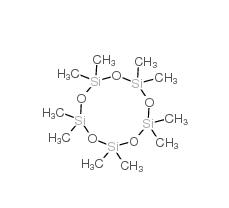

Octamethylcy-clotetrasiloxane

High efficient automobile detergent IOTA111

High efficient laundry detergent IOTA110

Smooth softener IOTA 17530

Polyester fluffy agent IOTA 17540

Divinyl-terminated methyl phenyl siloxane IOTA252

Methyl MQ silicone resin IOTA1200

Methyl MQ silicone resin IOTA7080 (powder)

Mica adhesive IOTA-500

Wetting agent IOTA245

High temperature mold release agent

High temperature resistant silicone oil

water soluble silicone oil IOTA-1291

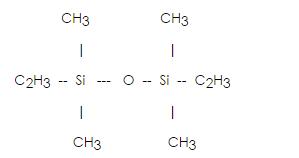

Polydiethylsiloxane (lubricant oil or instrument oil )

Dicyclopentyldimethoxysilane (D-Donor)

Cyclohexyl methyl dimethoxysilane (CMMS)

Tetra methylethylketoxime silane TOS

Methyltris methylethylketoxime silane (MOS)

Tetrapropoxysilane IOTA-933

Mercaptopropyltrimethoxysilane IOTA-80

Methacryloylpropyltrimethoxysilane IOTA-70

Epoxypropoxypropyl trimethoxysilane IOTA-60

Methyl phenyldimethoxysilane MPDMS

Diphenyldimethoxysilane DDS

Aminoethyl aminopropyl trimethoxysilane DAMO

Aminopropyltriethoxysilane AMEO

Vinyltrismethylethylketoximesilane VOS

Tetravinyltetramethylcyclotetrasiloxane V4

Vinyltrimethoxysilane VTMO

High performance lubricant release agent

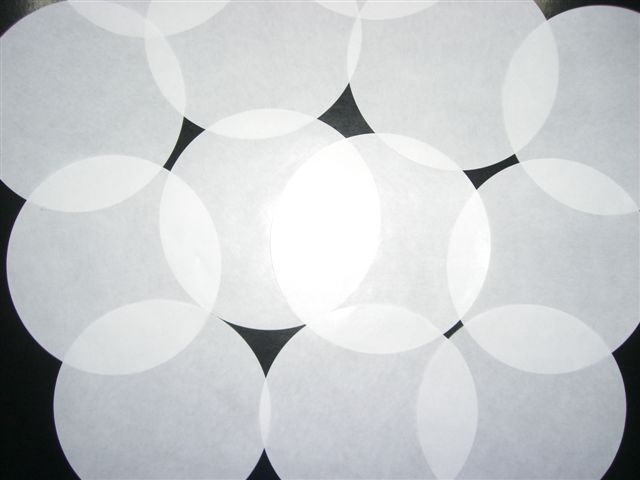

Glassine silicone paper

CCK Silicone Paper

CCK Release Paper

High refractive index LED package silicone gel IOTA4011

High refractive index LED package silicone gel IOTA4022

LED package Silicone gel IOTA3011

LED package silicone gel thickener IOTA204

Phenyl methyl hydrogen silicone resin IOTA207

Methyl phenyl vinyl silicone resin IOTA208

Phenyl-trisilane

Hexamethyldisilazane

Hexamethyldisiloxane IOTA 005

Triphenylchloromethane

7-methyl-3-siloxane

epoxy silicone oil

pigment printing thickener

polyester printing thickener

Chemical Fiber smoothing agent

Polyester smooth agent

Hydrogen termniated silicone oil

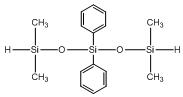

Tetramethyldisiloxane IOTA 606

Methyl Low Hydrogen silicone oil

Methyl High Hydrogen silicone oil

Dimethyl chlorosilane

TETRAMETHYLCYCLOTETRASILOXANE

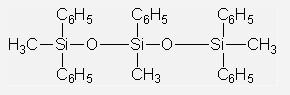

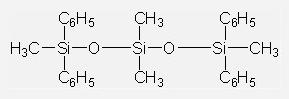

Tetramethyl diphenyl trisiloxane

Hydride terminated polyphenylsiloxane

Hydride terminated polydiphenylsiloxane

Hydrogen MQ resin

Vinyl silicone oil

Side chain type vinyl silicone oil

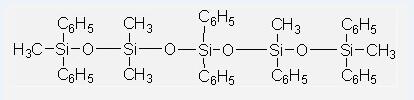

Tetramethyl diphenyl tetrasiloxane

Methyl silicone oil emulsion

Long chain alkyl silicone oil IOTA 2320

Divinyltetramethyldisiloxane(Vinyl double heads) IOTA 1002

Methyl phenyl resin IOTA-955

Methyl silicone resin IOTA 6070

Amino silicone oil IOTA 100

Amino silicone oil emulsions

Block amino silicone oils

Low viscosity silicone oils and Volatile silicone oils

Dimethicone methyl silicone oils IOTA 201

Hydroxyl silicone oils

Thread silicone oils IOTA205

High grade release papers

Glassine paper

Food grade greaseproof papers

Food grade silicone papers

Leveling Agents Iota3000

Agricultural silicone surfactants IOTA-2000

Vacuum Diffusion Pump Oils IOTA705

Phenyl Methyl Silicone Oils IOTA250-30

Phenyl Methyl Silicone Oils IOTA255

Phenyl Methyl silicone oil IOTA 556 (Phenyl Trimethicone, Cosmetic grade fluid)

Vacuum Diffusion Pump Oils IOTA702

Vacuum Diffusion Pump Oils IOTA704

皖ICP备14007495号

Copyright © 2000-2026 Iota Silicone Oil (Anhui) Co., Ltd, All Rights Reserved